property purchase tax in france

Foreign nationals are permitted to buy residential and commercial property in France as individuals or through a legal entity. Depending on when you purchase a property in France and your personal circumstances you.

French Taxes I Buy A Property In France What Taxes Should I Pay

Stamp duty is a.

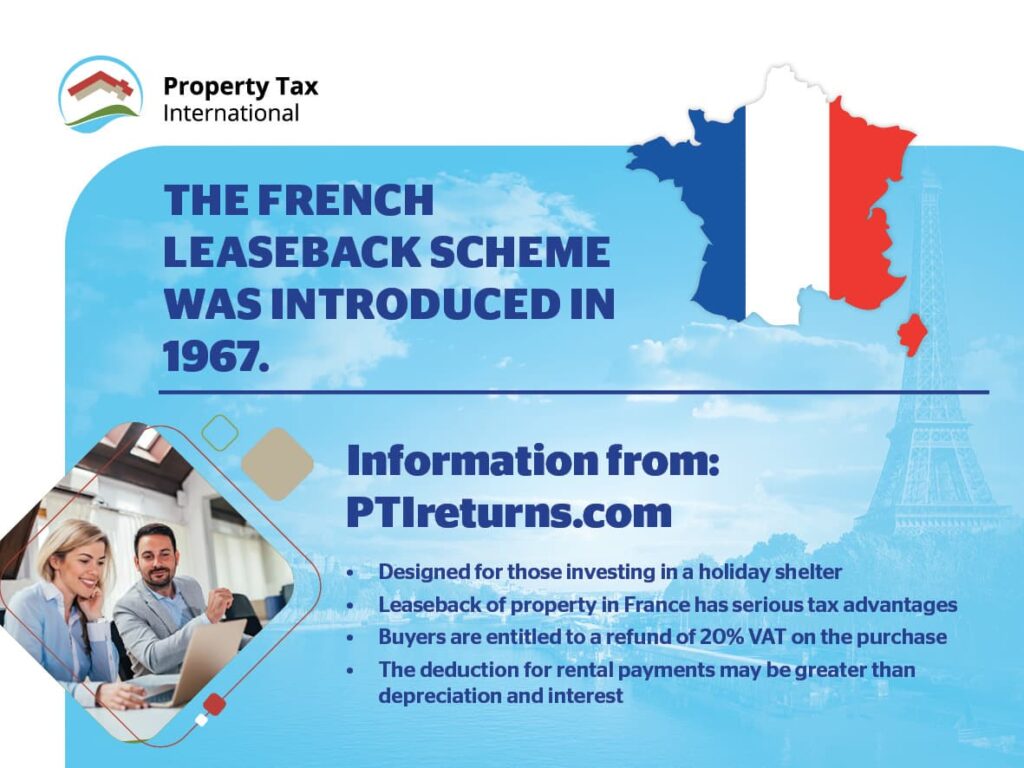

. Property Purchase Tax In FranceThese taxes are based on the cadastral value of the property. If you resell the property after year 10 for example and the new purchaser does not want to carry on with the lease activity you may have to repay 50 of the VAT that you. In the case of the purchase of an old property the total transfer of ownership costs and taxes payable for the purchase of an existing property is between 7 and 10 of the.

Before you start hunting for your dream holiday home in France here are five things that you need to know. Contact us on 44 020 7898 0549 from. Because the notary will calculate and charge all the relevant taxes during the purchase process you will not.

Speak to an expert. The French taxe foncière is an annual property ownership tax which is payable in October every year. There are two different taxes for property owners in France.

French income tax. The total taxes paid during the house purchase in France may add up 20 to the. There are a number of automatic calculators on-line that can be used to obtain an estimate of the fees taxes and other charges.

This is payable at the end of each year in December and can also be paid monthly. In France there are two main property taxes payable for new build purchases. Renting a real estate property in France generates rental income.

Calculating Fees and Taxes for Buying Property in France. The tax regime applied to rental income depends on whether the property is furnished or not. The notaire can advise you on the rate in.

In a very small number a lower rate of 509 applies. If you are renting out a French property the net income will be taxed at the scale rates of income tax ranging from 11 for income over 10084 to 45. If you are renting out a French property the net income will be taxed at the scale rates of income tax.

It is payable by the individual who owns the property on the 1st. In total these taxes amount to just over 20 per cent of the. What kinds of sales taxes are there in France when I buy or sell property.

The 172 French social charges cannot be offset against UK tax. Basis to tax. If you need assistance with your move we have a team of France property experts that can help at every crucial stage.

You might not be able to get a French mortgage. The first one is the taxe FONCIERE or land tax the second one is the taxe dHABITATION council tax which is. Because the notary will calculate and charge all the relevant taxes during the.

The initial purchase of a property in France will incur various fees and taxes. In the overwhelming majority of departments the taxes amount to 580 of the purchase price. French Property taxes - purchasing.

Consumption Tax Policies Consumption Taxes Tax Foundation

Property Purchase In France And Transfer Taxes

Taxes And Fees For Property Owners In France Properstar

Taxes On Real Estate In France On The Purchase Maintenance Accommodation Sale For Citizens And Residents Hermitage Riviera

Tax Implications Of Buying A Holiday Home Times Money Mentor

Buying Property In France Expatica

Income Tax In The Uk And France Compared Frenchentree

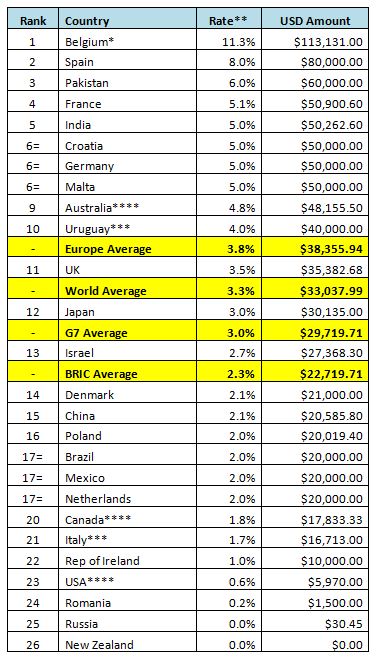

Uhy Major European Economies Levy Among The Highest Property Purchase Taxes In The World Onestopbrokers Forex Law Accounting Market News

House Hunting In France A Diamond In The Rough Near The Basque Coast The New York Times

Own A Holiday Home In France This Ultimate Tax Guide Is For You

Property Tax International Propertytaxint Twitter

What S Your French Property Costing You To Own

French Real Estate Podcast A Podcast On Anchor

What S Your French Property Costing You To Own

French Inheritance Law Assisting Foreigners Dedicated Services

Real Estate Taxes In France Star Leman Immobilier Lake Geneva Properties

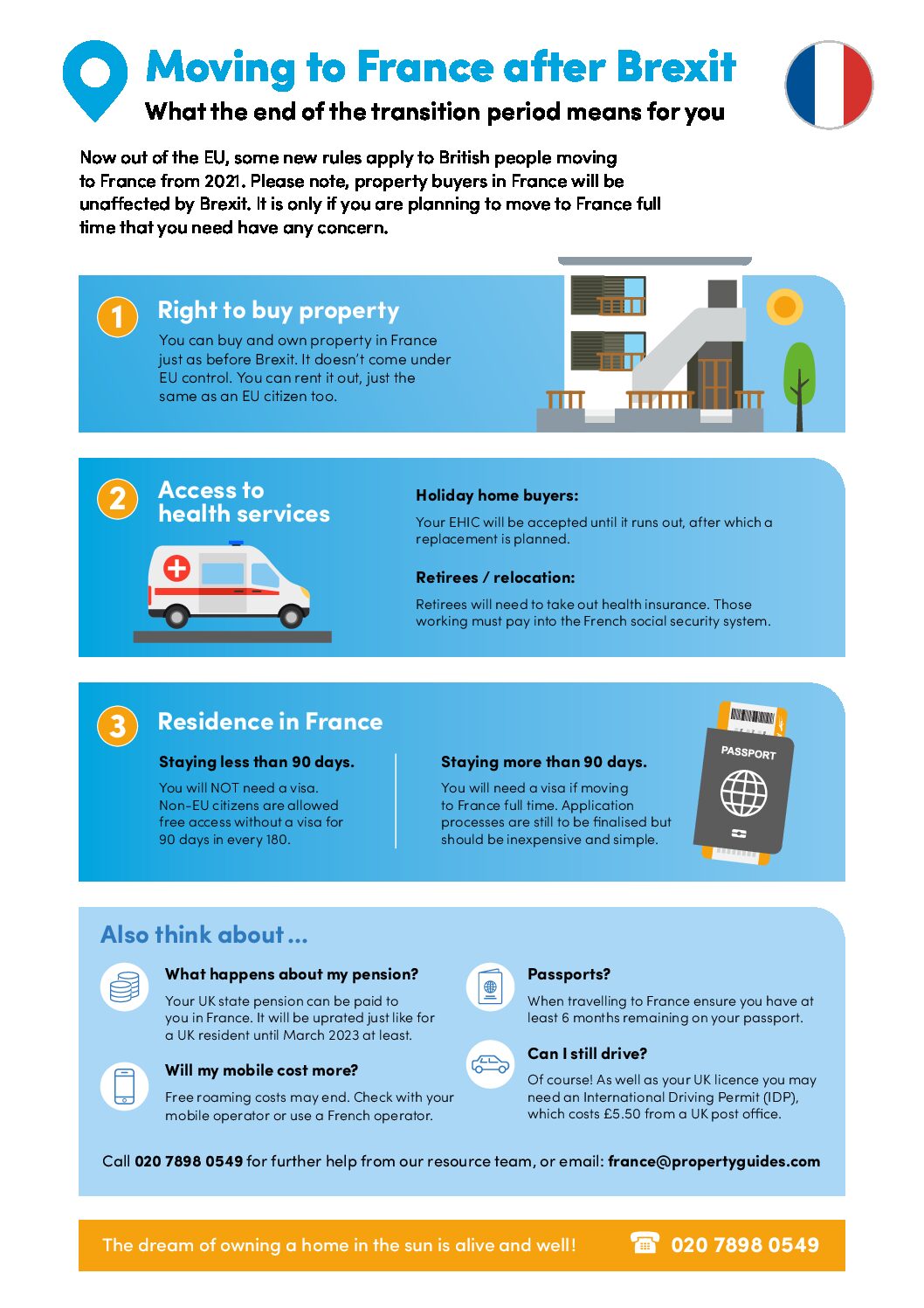

Buying Property In France After Brexit France Property Guides

Wealth Tax In France Keep Up With All The Changes Axis Finance Com